They’ll maintain their own financial statements including the income statement, cash flow statement, and balance sheet. In contrast, profit centers typically have more resources allocated to them, as their primary objective is to generate revenue and profits for the company. Moreover, cost centers contribute to efficiency by fostering a culture of continuous improvement. Through regular performance reviews and process audits, these units can identify inefficiencies and implement corrective actions.

Differences Between Cost Center and Profit Center

Profit centers are typically responsible for selling products or services to external customers. Examples of profit centers include sales departments, retail stores, product lines, and business segments. Cost centers and profit centers are two distinct concepts in business management that play crucial roles in financial analysis and decision-making. While both are essential for evaluating the performance of different business units, they have distinct attributes and serve different purposes.

The Key Performance Indicators (KPIs) for Cost Centers vs. Profit Centers – Notable Differences

In conclusion, cost centers and profit centers are distinct concepts in management accounting that serve different purposes within organizations. Cost centers are responsible for managing costs and resource allocation, while profit centers focus on generating revenue and maximizing profitability. Understanding the key differences between these two concepts is crucial for effective financial management and decision-making. By leveraging the benefits of both cost centers and profit centers, organizations can optimize their operational efficiency, control costs, and drive revenue growth. Cost centers and profit centers are two different types of organizational units within a company. A cost center is responsible for incurring costs and expenses, such as the finance or human resources department, without directly generating revenue.

- Techniques such as Lean management and Six Sigma can be employed to identify waste and improve processes.

- Profit centers are accountable for making strategic decisions, setting prices, and managing costs to maximize revenue and profitability.

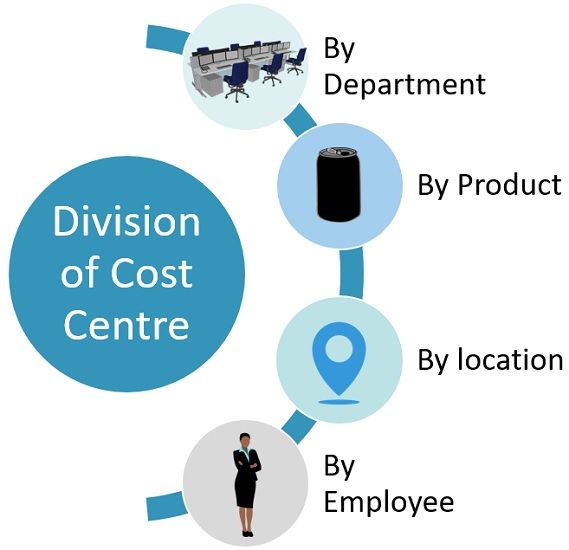

- Cost centers are any units or departments within a business that are responsible for incurring costs.

- On the other hand, a profit center is a subunit of a company that is responsible for revenues, profits, and costs.

- While both play crucial roles in understanding and managing business operations, they differ in their objectives and functions.

Innovate – Strategies for Effective Management of Profit Centers

Cost centers are any units or departments within a business that are responsible for incurring costs. For example, a maintenance department would qualify as a cost center because it spends how to create open office invoices with freshbooks money to maintain facilities and equipment rather than generating profit. Because managers take all the important decisions regarding product mix, promotion mix and technology used.

Meanwhile, profit centers typically have a higher level of decision-making authority, as their primary objective is to generate revenue and profits for the company. Profit centers have the autonomy and authority to make strategic decisions, set prices, and manage costs to maximize revenue and profitability. Cost centers are responsible for managing and allocating costs related to their activities. The performance of a cost center is evaluated based on its ability to keep costs within budgeted limits while delivering the required services or support to other departments. Cost centers are often evaluated using key performance indicators (KPIs) such as cost variance, cost per unit, and cost efficiency ratios.

Cost Control Mechanisms in Cost Centers

The aim is to determine the cost of each operation regardless of the location within the unit. Kia can identify the highly profitable car models by making a comparison of the profit made by each model. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Cost centers are typically responsible for managing costs, while profit centers are responsible for generating revenue. Therefore, a profit center may be better if the organization wants to hold managers accountable for revenue generation. Profit centers are primarily focused on generating revenue and profits, directly impacting the bottom line. In contrast, cost centers are essential for supporting operations but do not directly generate profits; instead, they incur costs that need careful management. Allocation of revenues and costs to profit centersis essential as it helps to identify relative profitability of differentrevenue generating divisions. This helps management in taking various decisionsrelated to income generating operations of the business.

GoCardless integrates with over 350 partners, including leading software including Chargebee, Salesforce, and Xero, to keep your workflow organized across multiple locations and branches. It can include using automated systems, software, and other tools to reduce manual work and increase accuracy. Similarly, a Supermarket chain like Big Bazaar or Walmart can identify their highly profitable stores by making a comparison of the profit made by each centre.

Define specific goals and targets for cost centers to ensure they align with the organization’s overall objectives. However, cost centers typically do not have the authority to make strategic decisions that directly impact the overall direction of the company or its revenue generation activities. The key performance indicators (KPIs) for cost and profit centers differ significantly based on their primary objectives. Explore the roles, impacts, and performance metrics of profit centers and cost centers to enhance business efficiency and financial strategy. Departments are generally classified on the basis of theirfunctions and their contribution to the business. Identification of departmentsis essential for multiple reasons including cost allocation and budgeting,staff management, profitability and efficiency analysis etc.

For instance, a customer service department might use data analytics to track response times and customer satisfaction, allowing them to refine their processes and enhance service quality. This focus on continuous improvement not only reduces costs but also enhances the overall effectiveness of the organization. Profit centers serve as the driving force behind a company’s revenue generation and financial growth. By operating as semi-autonomous units, they have the flexibility to adapt to market changes, innovate, and implement strategies that directly influence their profitability. This autonomy is not just a structural advantage but a strategic necessity, allowing profit centers to respond swiftly to customer demands and competitive pressures.